Startups are a delicate balancing act between acquiring new customers and maintaining their existing ones. Focusing too much on revenue growth is akin to trying to fill a leaky bucket with water. The startup sales team will continuously scramble to keep water in the bucket by bringing in new customers. In contrast, if a startup focuses too much on customer retention, it will result in stunted revenue growth, making it incredibly hard to demonstrate traction to investors. How can a startup successfully balance between the two?

The correct answer is a 70:30 bias for an early-stage startup: 70% of startups’ efforts should focus on acquiring new customers, and 30% on maintaining their existing ones. I recommend this ratio because a startup’s revenue growth rate is the most critical metric for investors. For example, No investor will fund a startup with a low revenue growth rate and perfect customer retention. Secondly, both a startup’s product and ideal customer segment will revolve rapidly in the first 12 to 24 months. In the early days of a startup, low retention (or a high churn rate) is simply the symptom of a startup finding its product-market fit.

Churn is often misconstrued as a concept solely meant for recurring revenue businesses (i.e., subscription businesses). However, churn is relevant to many types of companies. For this analysis, we’ll be using a two relatively simple definition of churn:

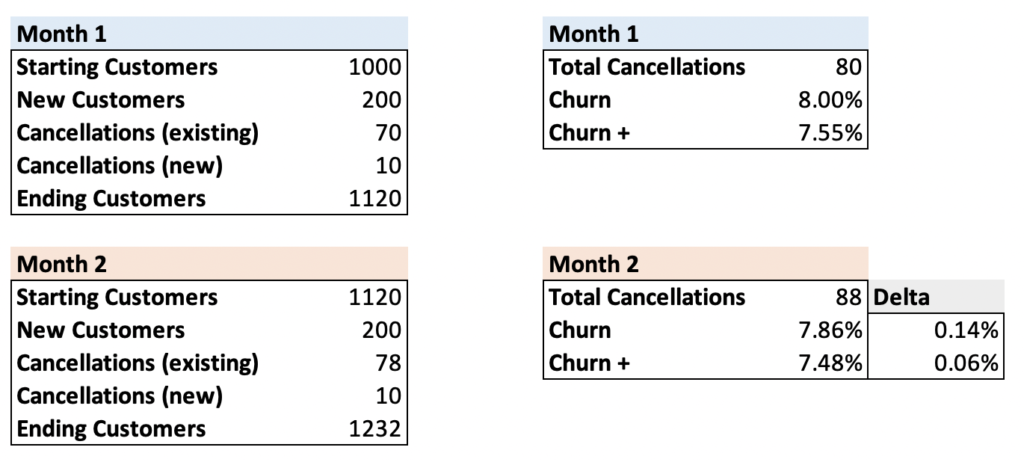

- Basic Monthly Churn = total churned customers/total customers at the beginning of the month

- Basic Monthly Churn Plus = total churned customers/((total customers at the beginning of the month + total customers at the end of the month)/2)

The basic monthly churn is the most common metric. I prefer the “plus” version that averages the number of customers at the beginning and end of the month because it provides a more reliable churn metric. Here is an example of what these formulas look like in real life:

In the above business, 7% of the existing customers cancel each month, and 5% of the new customers cancel during their first month. Using the “churn plus” metric, you can see that the delta between the two churn values is smaller with the churn plus metric. I also want to draw home the fact that no definition of churn is perfect. In this case, churn is identical in absolute percentages for each cohort, and yet the calculation yields an improvement. You can solve this problem by splitting your user base into cohorts (for example, new vs. recurring).

Also, for the record, there are a multitude of ways to calculate churn. If you don’t believe me, search “calculating churn” on Google. I found an article that provided no less than one hundred different definitions. I recommend finding one that works for you and establishing a consistent way of measuring churn that works for your business.

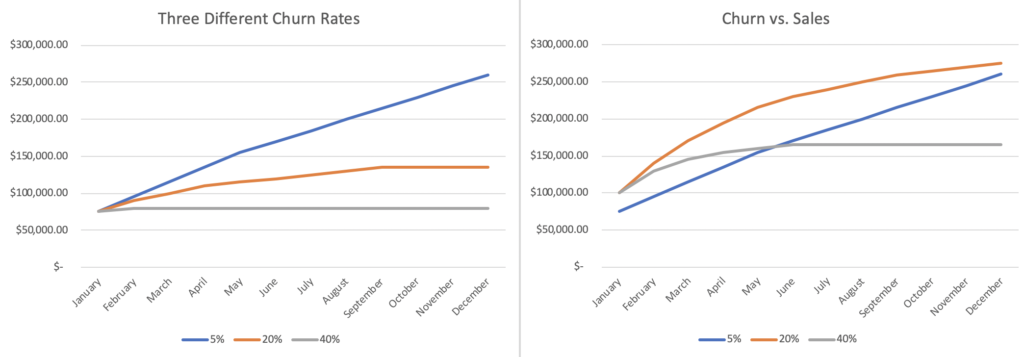

Below, we’ll analysis a few examples of the impact of revenue growth and churn on a startup’s growth. The example business sells a product with a standard one-size-fits-all $5,000-month contract that continues until canceled. At the beginning of the year, the company has ten customers and $50,000 in recurring business.

The example on the left, ‘Three Different Churn Rates,’ shows the same business with the same level of sales (5 new customers per month). The second example, ‘Churn vs. Sales,’ illustrates the same company with two sales levels: blue with five new customers per month rate, and orange and grey with a higher rate of 10 new customers per month. The blue line represents a 5% monthly churn rate, orange 20%, and grey 40%:

Here is what we can observe from the above:

- The grey business with a high churn (40% monthly) struggles to grow with a high level of sales and remains flat throughout the year with a medium level of sales. If your churn rate is too high, it isn’t easy to fix it with sales.

- The blue business is identical in both graphs, growing steadily from $50K to $260K in monthly revenue. If you have excellent customer retention, you don’t need incredible sales to grow.

- The orange business struggles to grow with average sales and exceeds the blue business’s performance ($275K vs. $260K MRR by the end of the year) with a high-level of sales. You can overcome a moderate churn rate with a high level of sales.

The second example demonstrates why a 70:30 ratio bias between sales and retention is the correct ratio for an early-stage startup. A moderate level of churn is expected in an early-stage company because the product-market fit is in flux, and some experimentation is required. Over time, as the business matures, the product, customer segmentation, and marketing will improve, resulting in a lower churn level. A high level of sales can overcome a moderate churn level, which we demonstrated in the above graph. However, if your churn rate is too high, your company is fighting a neverending, uphill battle. Hence, startup leaders should focus 70% of their attention on acquiring new customers, and 30% on retention.