The future is uncertain and building safeguards into long-term deals increases the comfort of both parties and accelerates closes. Safeguards allow clients and providers to build “If/Then” logic into agreements. For example, a termination clause that allows the customer to terminate their long-term agreement under certain circumstances. When safeguards are used properly, they are a powerful tool to increase long-term deal volume and client retention.

Here are some examples of deal safeguards:

- Selective termination – provide the client with the right to terminate the deal under clearly defined conditions, for example, product performance below a specified threshold for two consecutive quarters.

- 3rd party review – leverage an independent third party to review deal performance at key dates (ex: 6 months) and make recommendations on a path forward. You can combine 3rd party review with selective termination.

- Staggered value unlocks – reducing rates and/or unlocking other value at defined milestones based on your client meeting certain spend thresholds. Ex: once a client invests $X, the price paid per unit drops by x%. Staggered unlocks allow you to incentivize the client to continue investing and simultaneously protect you if their spending declines by limiting the hit to your margin.

The correct frame of mind is ‘how can I ease my customer’s concerns about committing to a long-term deal while keeping the deal exciting for my business.’ If you’re wielding safeguards with that mindset, you’ll end up in the right place.

Here are some general rules of the road for safeguards: if you see a common objection surfacing across many long-term deals, build a safeguard into your standard deal structure that addresses it. Secondly, if you present a large deal to a customer with evident concern, try to ‘read their mind’ by building a custom safeguard into the initial deal structure that addresses their concern head-on. Last and certainly not least, If you’re negotiating with a customer and the list of safeguards continues to grow, it’s probably best to walk away. From my experience, I cannot think of a single instance of an overly complicated deal that worked out well in the long run.

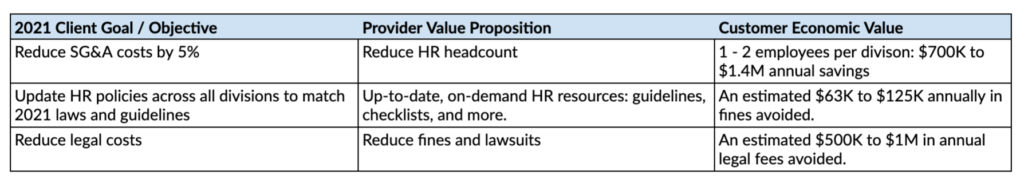

In our previous example, the HR SaaS service provider, what do we think our client’s objections will be? To recap, we estimated that the client was receiving the following economic value from the deal:

The client is currently paying $21K per month, and by agreeing to a long-term deal, they’ll reduce their monthly cost by up to 30%. In this case, let’s say the client is confident in the reduction in SG&A, in which case we’ll focus on the additional value obtained from avoiding HR fines and lawsuits. Ideally, we’d like the customer to commit to a two-year contract, and we believe that the discount we’re providing is adequate to justify a one-year commitment. So let’s focus on the two-year deal.

The client may want to cancel after one year if they’re hit with fines and lawsuits well above what they expect. In other words, our software may not be sufficient, and the client may need to restructure their HR department and hire more people internally, increasing their costs. This potential scenario will bring into question the ROI of our software. To counteract this objection and differentiate the two-year deal from the one-year deal, we’ll design a safeguard that offers a 3rd party evaluation and an option to terminate at the deal’s midpoint.

We’ll hire a mutually-agreed-upon 3rd party consultant to evaluate their HR practices and estimate the fines and legal fees avoided approaching the one-year mark. If the estimates are below a defined threshold (let’s say our low-end estimates above), the client will have the option to cancel the two-year deal at the one-year mark. Once the one-year mark passes, the agreement will continue to its full two-year term.

Notice that the deal does not automatically terminate. Instead, we’re saying that if the product isn’t performing well for the client, they can cancel before the beginning of the 2nd year. We’re also agreeing to hire an independent third party to perform the evaluation, which comes at some risk and shows that we believe in our product. Plus, as a side benefit, we’re gaining independent insight into how our product functions for customers, which will be helpful for our company.

Now that we’ve planned our safeguards, we’re ready to finalize our work and bring the finished product to our customer. In part six of my series, we’ll present the initial deal options to our customer to gather feedback and hopefully put us on a pathway to a closed deal.