Closing large, long-term deals requires creating deals that align with your client’s objectives and unlock multiples of value versus short-term deals. The choices should be structured so that the top choice is a stretch yet within the realm of reason (for example, if realistically your client can afford ~$2M a year, don’t show them a $20M annual deal option, but you could show a $4M). The value creation should be obvious, and the value multiple should increase more than the commitment size at each deal level.

In other words, the value should not scale linearly as the deal size increases. Clients should be incentivized and rewarded for committing to more extended periods or larger spend targets. Remember, in exchange for providing more value to the client, the client provides your business with dependable cash flow. The largest option should provide eye-popping value for a stretch-level commitment if the deal options are structured well.

Let’s use our previous example discussed in Part 2 and 3 to structure some value multipliers. In the last article, we calculated the economic value for a fictional HR SaaS company. Here’s a quick recap of the situation:

- Our client purchases our HR SaaS product on a month-to-month agreement (cancel anytime) for $3,000 per month PER division.

- The total cost is $21,000 per month, or $252K annually.

- Our objective is to have our customers agree to longer commitments, ideally 1 to 2 years, allowing our business to have reliable cash flow and reduce churn. It is relatively safer to scale a company with many longer-term customer commitments.

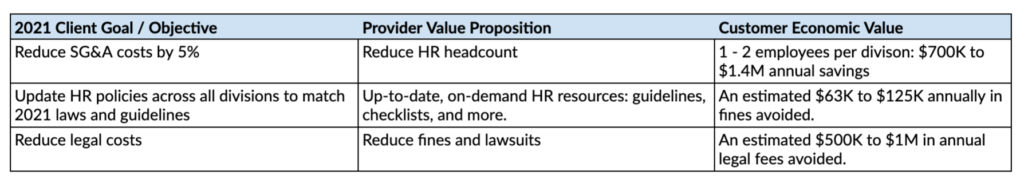

And here are the client’s objectives aligned to our products value proposition and the estimated economic value created:

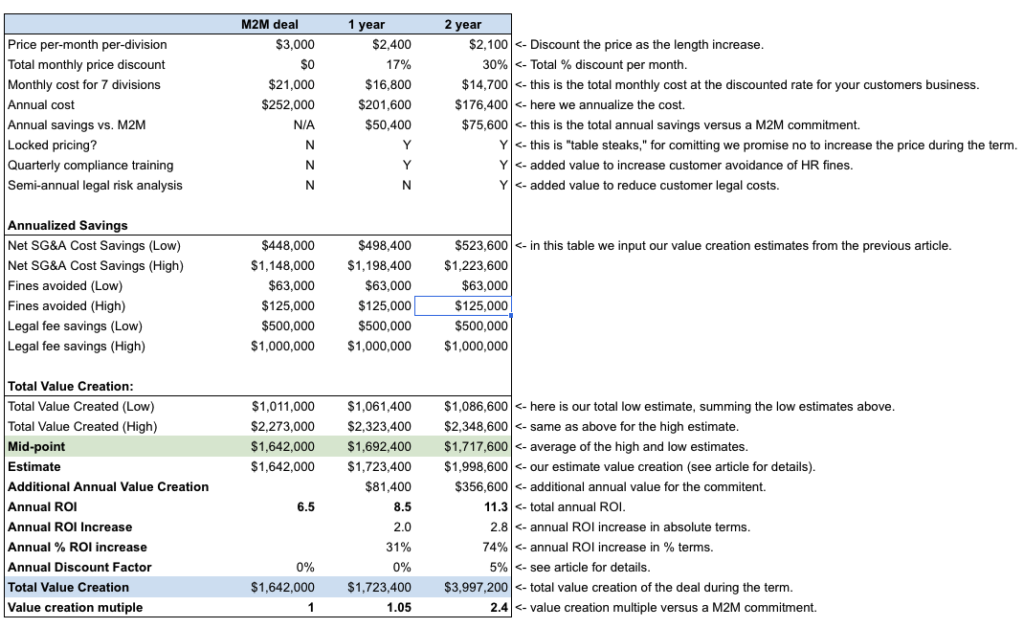

The next step is to brainstorm your options for increasing deal value and begin constructing a deal model. The most apparent levers for our example product are reducing the monthly price and locking the price during the deal term. It is also helpful to design additional deal items to increase value creation aside from price discounting. For example, in addition to discounting the monthly price, we added two unique items to the long-term deal structures shown below: quarterly compliance training and semi-annual legal risk analysis to improve value creation.

Click below to download a copy of the model:

The above model compares a month-to-month (M2M) deal with one-year and two-year commitments. The one-year commitment provides a 17% monthly price discount per company division, equating to a $50K annual savings. We’re also providing quarterly compliance training classes for each company division to reduce our customer’s HR errors and the resulting fines. The combination of the reduced monthly price and the decreasing penalties from the quarterly compliance training results in an estimated $81,400 of additional value per year, which increases our customer’s ROI by 2x, from 6.5x ROI per year to 8.5x.

The customer receives a 30% monthly price discount per company division for the two-year commitment, which equals $75,600 in annual savings. We’re also providing quarterly compliance training and a new item, semi-annual legal risk analysis, to reduce annual legal fees. The two-year deal provides a total additional estimated $356,600 in value creation per year, increasing our customer’s yearly ROI by 2.8x, from 6.5x ROI per year to 11.3x

For each case, we model value creation differently. For the M2M deal, we’re averaging our low and high-value creation estimates for S&GA, HR Fines, and legal fee savings and summing them together. We use the same formula for the one-year commitment, except we use the high case for HR fines avoided, which is our estimated result of the additional quarterly compliance training. We similarly use the high-case for both avoided penalties and legal fee savings for the two-year commitment because of the semi-annual legal risk analysis.

Next, we compare the total value creation from each deal:

- Month-to-Month: $1.64M annually (assuming no price changes). For comparison, the M2M deal provides a value multiple of 1.

- One-year: $1.72M annually with locked-in pricing. The one-year commitment provides a value multiple of 1.05 versus the M2M commitment (again, assuming no price increases).

- Two-year: ~$4M over 24 months with locked-in pricing. We’re discounting the 2nd year’s value creation by 5% because value creation in the future is not as valuable as value creation today. The two-year commitment provides a value multiple of 2.4.

In other words, the customer receives 2.4x the total estimated value creation of a month-to-month deal by committing now for two years.

The key is to frame deals in the customer’s present state because there are unknown elements in the future that may impact value creation. For example, your company may decide to increase M2M rates by 50% in 6 months due to higher than expected customer ROI and the resulting higher demand. If prices rise, then the 1-year and 2-year commitments become more valuable versus the M2M option. Alternatively, new HR laws might be approved that increase fees or lawsuits, increasing the value creation of the long-term commitment.

The point of this exercise is the mindset. By estimating the value creation of long-term commitments and framing the value creation in your customer’s language (their goals and objectives), you’ll create much more compelling sales proposals with higher win rates. Most sales teams provide customers with basic information, for example, an overall price discount, leaving it to the customer to do the math on their value creation. By doing the calculation to estimate value for your customers, you’ve already up-leveled your conversation.

The future is scary, and by providing locked-in pricing, additional value, and value creation estimates, you have de-risked the commitment for your customers. However, in many cases, that is not enough to entice customers into long-term deals. In part five of my series, we’ll discuss how to build in deal safeguards to protect both yourself and your customers, allowing you to progress from consideration to closed.